As mentioned in my other post on the best travel credit cards, travel hacking is one of the best ways to sponsor your travels. Credit cards pay a huge role in making that possible. Many cards offer great welcome sign up bonuses in points that can be redeemed for travel or cashback. However, to get the bonus, there is always a spend requirement. This spend can vary anywhere from $200 to $5000+. The period for this spend is usually 3-5 months from the date of application.

Now, you might be thinking “I don’t normally spend that much, how do I meet that spend requirement?” Indeed, you don’t want to make unnecessary purchases and spend more money than usual to get the bonus points. It would not be logical to do that. Never buy something that you don’t need and don’t get into credit card debt. After all, the goal of the credit churning is to earn rather than spend.

Here are some of the ways to meet credit card minimum spending requirements –

1. Plan ahead

Look at the expenses that may be coming up in the next few months. Some examples could be wedding, shopping, travel, social events, university or tuition fees, etc. If you can approximate the spend on these activities and believe these are considerable expenses, sign up for a new credit card ahead of time. You can also use one card to pay for all recurring monthly utility payments such as electricity, gas, water, trash, internet, phone bill, car insurance, etc. Use that card for all daily expenses.

Wedding is a great time to churn credit cards

2. Put a down payment on a new car

Planning to buy a new car? Many dealerships allow you to put a down payment on the car with a credit card. The cap limit for paying with a credit card is usually $5000. Some dealers will let you charge the entire amount to the card if you are buying through the card issuer’s auto purchasing plan. Eg. American Express Auto Purchasing Program. Make sure to check with the dealership before you decide on the purchase.

Some dealerships allow down payments using credit cards

3. Pay your medical expenses with a card

Let’s say you have some medical expenses coming up that you are paying out of pocket. These could be charges that are count towards your insurance deductible or pharmacy or medical tests. Instead of using a HSA debit card, charge it your credit card and reimburse the expenses from your HSA to your bank account.

In some cases, you can pay the medical expenses upfront with a credit card before claiming with the insurance. The insurance will reimburse you for the qualified costs instead of the medical provider. Do thorough research before doing this as health insurance expense disbursements are tricky in America. Learn more about why you should open an HSA.

4. Prepay your auto insurance, phone or utility bills

This is one of the simplest methods. Instead of paying monthly for auto insurance that charge for transaction fees, you can pay it in full for 6-12 months. If you decide to switch insurance providers, they can refund you the remaining amount.

5. Buy gift cards

You can purchase gift cards that you plan on using for yourself or gifting your friends or family. Think of Amazon gift cards which you may use later. Also, if you use a credit card such as the Chase Business Ink Cash and buy these gift cards at Staples or Office Depot, you earn 5% back. Another creative way is getting prepaid re-loadable cards by American Express such as Bluebird or Serve and using visa gift cards to load money. However, be wary of the later method to meet minimum spend as some credit card issuers do not count these towards the spend threshold. They could also be coded as a cash advance.

Img credit-401kcalculator.org

6. Get reimbursed through friends and family

Check with your friends and family if you can pay for their expenses using your credit card, and get them to pay you back with Venmo, PayPal or other payment methods.

7. Get reimbursed for business expenses from work

If your job requires business travel or purchasing of office supplies, use your personal credit card for purchases and get them reimbursed from your employer.

8. Pick up the tab for friends and family

There are times when you’re out for a meal with family or colleagues or hanging out friends who are lazy to pay the check with their cards or don’t like the idea of splitting expenses with multiple cards. In some cases, there is a restriction on the number of cards the server will accept for a party of customers. That’s your time to shine. Put down your card! Pay for the meal and get it reimbursed from your friends or family via online payment services such as Venmo or Paypal. You can also use services like Splitwise to itemize the expenses.

9. Add an authorized user

With many credit cards, you can add authorized users on your account such as a close friend, a partner or a family member. They will use your card for regular expenses and you can meet the minimum spend faster. Authorized users do not have visibility into your account. You are liable for all the expenses and credit on the card. Only do this with people you trust. If you are planning to use a Player 2 for your credit card churning strategy, I would not recommend adding Player 2 as an authorized user as it may count towards their Chase 5/24 quota.

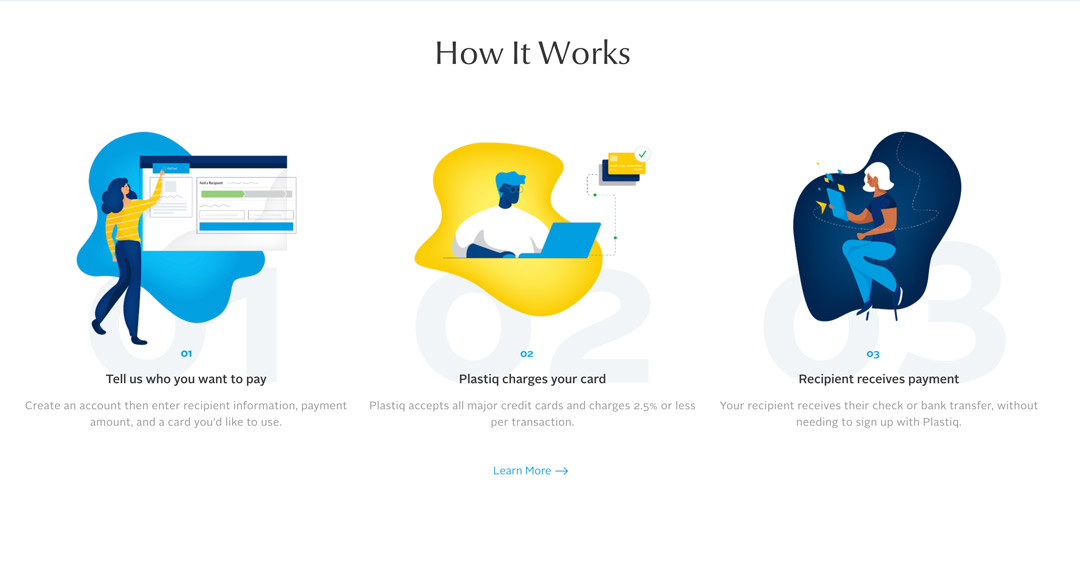

10. Use a service like Plastiq

One of the simplest ways to reach minimum spend is using a service like Plastiq. It is a service that lets you pay almost any bill or service with a credit card, even if those vendors and services that do not accept credit cards. Plastiq charges a flat 2.5% fee, however they frequently run promotions with lower rates or fee waivers. Calculate the fee Vs the bonus amount you get after meeting the minimum spend to make sure you are benefiting with using Plastiq.

Plastiq is a great resource to pay rent or bills with a check

You can try Plastiq and get $500 in fee-free payments after you spend $500 with my link – http://bit.ly/Plastiqpay

Plastiq is a great way to pay for rent as many landlords or leasing offices do not accept credit cards. Since this is one of the biggest monthly expenses for many, you can use Plastiq to pay the landlord or leasing office with a check.

What are your tips for meeting the minimum spend or credit card churning? Share in the comments below.